Feeling like you’re drowning in mortgage debt?

You’re not alone. Every month, homeowners in Warner Robins, Hawkinsville, and across Middle Georgia face tough decisions about keeping their homes — and one option some consider is giving the house back to the bank.

But is it really as easy as tossing the keys on the kitchen counter and walking away?

Spoiler alert: It ain’t. There can still be consequences to not paying off the mortgage as agreed per the terms of your loan.

Let’s break it down, Middle Georgia style.

What You Need to Know

So, things got tough. Maybe the job slowed down, the car broke down, or the bills piled up quicker than you expected. And now the bank is breathing down your neck.

If you’re facing foreclosure in Warner Robins, Hawkinsville, or anywhere in Middle Georgia, you might be wondering:

“Can I just give the house back to the bank and be done with it?”

The short answer: Yes, you can.

But the long answer? You’ll want to read this first.

What Does It Mean to “Surrender” a House to the Bank?

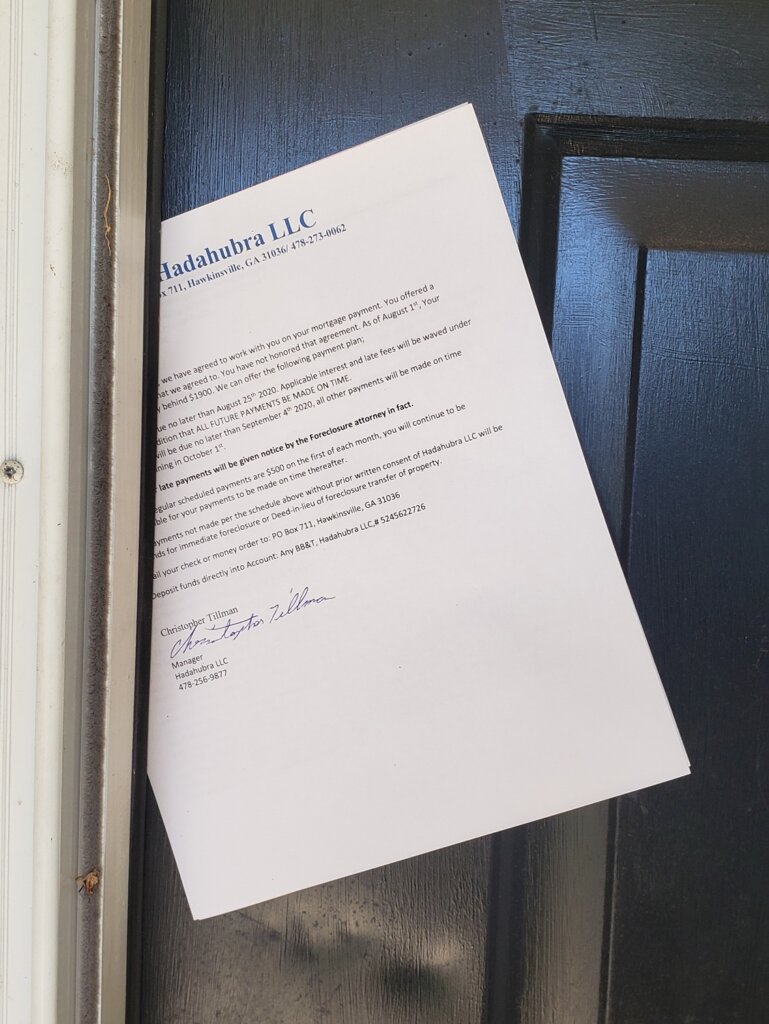

When people talk about “giving the house back to the bank,” they’re usually referring to something called a deed in lieu of foreclosure. This is a formal agreement where the homeowner signs over the property to the lender to avoid a full foreclosure process.

Sounds simple. But the truth is…

The bank doesn’t have to accept it.

In fact, most lenders would rather foreclose, even if it costs more, than negotiate unless they see clear benefits to taking the house back voluntarily.

Watch this to learn about the Foreclosure Process.

Pros and Cons of a Deed in Lieu of Foreclosure

✔ Stops the Foreclosure Process Early

You might avoid having a foreclosure hit your credit report altogether.

✔ Saves Legal Fees

The bank doesn’t have to pay a lawyer to foreclose, and you don’t have to stress about court dates.

✔ Could Lessen the Hit to Your Credit

While your score may still drop, it won’t drop as hard as a full-blown foreclosure.

✔ Faster Resolution

This process can often wrap up faster than foreclosure in Georgia, which already moves quick—just four weeks from notice to auction.

❌ It Still Hurts Your Credit

Your credit will still take a hit—just maybe not as deep as a foreclosure. Expect your score to drop by 100–200 points.

❌ You Might Still Owe Money

Yep. The bank might still pursue a deficiency judgment—that’s the difference between what you owed and what the house is worth.

❌ Not All Banks Will Do It

Many lenders won’t agree to a deed in lieu unless they’ve already tried other options, like a loan modification or short sale.

When Does It Make Sense to Consider This Option?

Giving your house back to the bank might sound appealing if:

- You’ve tried everything else (selling, loan modification, etc.)

- You’re behind on payments with no equity

- The house needs repairs you can’t afford

- You’ve got a job transfer, divorce, or financial crisis

But before you hand over the keys, consider the consequences…

At Real Estate Problem Solver, we’re professional real estate investors. Contact us today at (478) 273-0062 to find out what we can offer you for your house — even if it needs repairs.

What Happens to Your Credit?

Yep — a deed in lieu still damages your credit.

Not as bad as a full-blown foreclosure, but bad enough to make a future home loan difficult for 2–4 years.

Pro tip: If you can sell the house before it gets this far, you might protect your credit and even walk away with some dignity (and maybe a few bucks in your pocket).

What Are Your Other Options?

In many cases, YES. And that’s where we come in.

If you’re in Warner Robins or Hawkinsville and thinking about giving your house back to the bank, you have alternatives. Here are a few routes we help people take:

🏠 Sell Your House Fast

We can make a cash offer and close in days. Even if you’re upside down or in pre-foreclosure, we may be able to help with a creative solution.

💼 Short Sale

You might be able to sell for less than what you owe—and we’ll negotiate with your lender to help make that happen.

🧾 Loan Modification

If your lender is open to it, you may be able to adjust your loan terms and stay in the home.

🏃 Bankruptcy (As a Last Resort)

Yes, it can stall a foreclosure—but it stays on your credit for years. It’s a tough choice and should only be considered with legal advice.

Warning: What Not to Do

Do not just pack up and walk away.

That’s called abandonment, and it:

- Can leave you legally responsible for property damage

- Won’t stop foreclosure

- Still tanks your credit

- Might open you up to lawsuits or deficiency judgments

Always speak to someone before taking that leap.

Ready to Explore Your Options?

If you’re thinking about giving your house back to the bank in Warner Robins or Hawkinsville, let’s talk first. You may still have time to sell your house fast — or at least avoid foreclosure.